FEEDBACK: If the price level in the later time is greater than the price level in the earlier time, the conversion of the earlier price will make the earlier price greater than its original value.

Using our formula for calculating the inflation rate, the rise in healthcare costs raised the overall price level by 1.2%.

(101.2 – 100) ÷ 100 × 100 = 1.2%.

FEEDBACK: Suppose the CPI in the first year is 100. If healthcare costs are 8% of total expenditures then they account for 8 of the 100 points, with the 92 other points falling in other categories. If healthcare prices rise by 15% in the second year, then those 8 points become 9.2 points. Since the prices of the other categories have not changed, the CPI now stands at 101.2, since 9.2 + 92 = 101.2.

Using our formula for calculating the inflation rate, the rise in healthcare costs raised the overall price level by 1.2%.

(101.2 – 100) ÷ 100 × 100 = 1.2%.

FEEDBACK: When evaluating a raise, you need to account for the rate of inflation over the course of a year. If the inflation rate is greater than the percentage raise in your wage, then you are worse off, as your real income will fall. If the inflation rate is lower than the percentage raise in your wage, then you are better off, as your real income rises. Keep in mind that we want to examine real income and purchasing power as opposed to nominal income and purchasing power. If we think a raise of 5% is great when the inflation rate is higher than 5%, then we are suffering from money illusion.

FEEDBACK: $1,688,693.10. Recall that to convert 1991 prices to 2012 prices we need to multiply the old price by the ratio of the CPIs. $1,000,000 x (230.0 / 136.2) = $1,688,693.10.

FEEDBACK: For this question, you would need to know how many future dollars match today’s dollar. By using the bar chart in the Economics for Life box we can determine the equivalent of $1 in 40 years. The x-axis tells you that, at an inflation rate of 3%, you would need $3.26 (in 40 years) to match today’s $1. To have enough savings to supply you with the equivalent of $40,000 per year at 3% average inflation rate: take 40,000 × $3.26, or $130,400 per year, just to keep pace with inflation.

FEEDBACK: The average consumer spends a much larger portion of their income on housing as compared to concert tickets, so the increase in the price of homes will have a larger impact on the CPI.

FEEDBACK: If inflation 3 percent turns out to be greater than your salary, increase, 2%, then you the worker, will suffer because your salary will not allow you to afford the same basket of goods and services that you bought the previous year. If inflation, 1% turns out to be lower than your salary increase, then Wells Fargo is worse off. In a case like this the price at which a firm must pay their employee rose by more than the prices at which they could sell their goods.

FEEDBACK: In December 2012, the CPI stood at 231.1, up from 211.4 in December 2007. This is a 9.3% increase: (231.1 – 211.4) ÷ 211.4 × 100 = 9.3.

If real gdp grows at 3% and inflation is equal to 2%, with no change in velocity we would have the following %ΔM + 0 ≈ 2% + 3%. Thus %ΔM ≈ 5%. If real gdp falls by 3 percent with no inflation, and the money supply grows by 5 percent, then 5% + %ΔV ≈ 0 + -3%. So the %ΔV ≈ -8%.

If real GDP increases by 3 percent, with no change in velocity, and money supply grows by 10%, then 10% + 0 ≈ %ΔP + 3%, so%ΔP ≈ 7%.

The equation of exchange in rates of growth is %ΔM + %ΔV ≈ %ΔP + %ΔY

If real gdp grows at 3% and inflation is equal to 2%, with no change in velocity we would have the following %ΔM + 0 ≈ 2% + 3%. Thus %ΔM ≈ 5%. If real gdp falls by 3 percent with no inflation, and the money supply grows by 5 percent, then 5% + %ΔV ≈ 0 + -3%. So the %ΔV ≈ -8%.

If real GDP increases by 3 percent, with no change in velocity, and money supply grows by 10%, then 10% + 0 ≈ %ΔP + 3%, so%ΔP ≈ 7%.

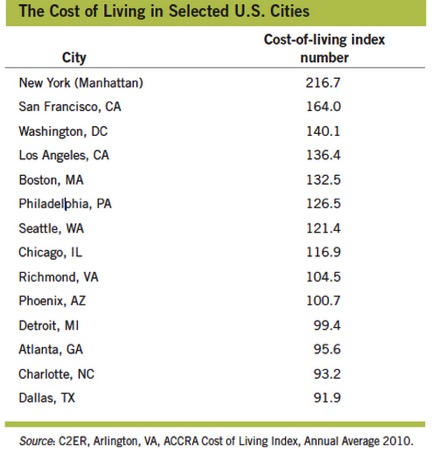

FEEDBACK: Using the information provided in the table, plug in the appropriate values. The cost of living index is 100.7 for Phoenix and 216.7 for Manhattan. In this case, you just need to multiply each index by 1,000: a salary of $100,700 in Phoenix is equal to a salary of $216,700 in Manhattan. Your nominal wage might increase significantly, but your real wage will not; it would take $216,700 per year in Manhattan to maintain the same standard of living you enjoyed in Phoenix.

FEEDBACK: Looking at the definition, and how we use CPI to measure inflation, we can see that inflation means we have an overall price increase, not just a price increase for one or two items. With an overall increase, the price of some items may even fall while others are rising; as long as the net impact is an increase, we have inflation. The basket of goods represents the typical urban family, so not every consumer buys every item in the basket. For example, the price of higher education increases more than the overall inflation rate, yet not everyone is attending and paying for college, so this increase will affect college students more than other members of the population. Or, if the price of hay is rapidly increasing, that is not included in the CPI calculation because it’s not purchased by the typical urban family. Deflation is a sign of an unhealthy economy, and hyperinflation leads to price confusion as well as other problems.